Case law / Opinion letters

Attorney Opinion Letter (Rosen):

IRS Tax Code Regarding Irrevocable Trusts

As to the Internal Revenue Code, the Trusts were all written to be in full compliance with the Code and operate within the law and its guidelines. The rules and laws that govern the described operation of the Trust is contained in various sections of the Code but particularly in the following:

Internal Revenue TITLE 26,Subtitle A, CHAPTER 1, Subchapter J, PART I, Subpart A, Sec 643 (a)(3), (4), (7) and (b) states:

“(A)(3) Capital gains and losses. Gains from the sale or exchange of capital assets shall be excluded to the extent that such gains are allocated to corpus and are not (A) paid, credited, or required to be distributed to any beneficiary during the taxable year, or (B) paid, permanently set aside, or to be used for the purposes specified in section 642(c). Losses from the sale or exchange of capital assets shall be excluded, except to the extent such losses are taken into account in determining the amount of the gains from the sale or exchange of capital assets which are paid, credited, or required to be distributed to any beneficiary during the taxable year. The exclusion under section 1202 shall not be taken into account.

(B) Income constituting Extraordinary Dividends [i.e. profit and/or income] or taxable stock dividends which the fiduciary acting in good faith, determines to be allocable to corpus under the terms of the governing instrument and applicable local law, shall not be considered income.”

IRS Tax Code Regarding Irrevocable Trusts

Weeks v. Sibley DC 269£, 155

Edwards V. Commissioner. 41512£!, 532 10th Cir. (1969) and

Philips v. Blanchard 37 Mass 510,

The courts ruled that the organization of a Spendthrift Trust is not illegal even if formed for the express purpose of reducing or deferring taxes.

Edison California Stores, Inc. v McColgan. 30 Cal 26472.183 P2d 16.

Ruled that persons may adopt any lawful means for the lessening of the burden of income taxes.

The Department of the Treasury, IRS Handbook for Special Agents § 412,

Ruled that tax avoidance is distinguished from tax evasion and states; “avoidance of taxes is not a criminal offence. Any attempt to reduce, avoid, minimize, or alleviate taxes by legitimate means is permissible”.

Ruled that It is not an evasion of legal responsibility to take what advantage may accrue from the choice of any particular form of organization permitted by law.

Trusts Are Not Subject to Legislative Control

Another major advantage to operating a Spendthrift Trust Organization as a business is that, because it is not a creature of the legislature, it is not subject to the myriad of strangling legislative controls, rules and regulations that are applicable to corporations and other legislative entities as ruled by The Supreme Court in:

Eliot v. Freeman 220 US 178 (Argued January 19, 1911, Decided March 13, 1911 – 220 U.S. 178)

Ruled that a Spendthrift Trust Organization is not subject to legislative control. The Supreme Court holds that the trust relationship comes under the realm of equity based on common law and is not subject to legislative restrictions as are corporations and other organizations created by legislative authority.

This case came about as it was the intention of Congress to embrace within the corporation tax provisions of the Tariff Act of August 5, 1909, c. 6, 36 Stat. 11, 112, only such corporations and joint stock associations as are organized under some statute, or derive from that source some quality or benefit not existing at the common law.

A trust formed in a state, where statutory joint stock companies are unknown, for the purpose of purchasing, improving, holding and selling land, and which does not have perpetual succession but ends with lives in being and twenty years thereafter, is not within the provisions of the Corporation Tax Law.

Hussey v. Arnold 182 U.S. 461, 21 S. Ct.645

“Trust property cannot be held under attachment nor sold upon execution for the trustees personal debts”

Hussey v. Arnold 182 U.S. 461, 21 S. Ct.645 / Mayo V. Morin, 24 NE 1083

The fact that the trustees hold the property does not mean that the trustee(s) own the personal property. Trust property cannot be held under an attachment nor sold upon the execution of trustee’s personal debts. Trustees and beneficiaries cannot be held liable for debts incurred by the trust. If in fact, a trust has been created, the certificate holders are not liable on the obligation incurred by the trustees or managing agents appointed by the trustees.

Pursuant to 695.30(a) of the CPC for the State of California (and similar Civil Procedure Codes of other states);

“property of the judgment debtor that is not assignable or transferable is not subject to the enforcement of a money judgment”.

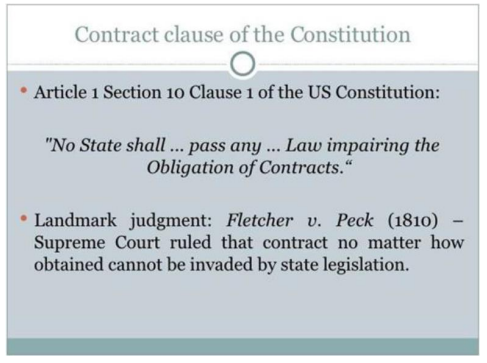

The “right to contract” is guaranteed under the United States Constitution Article §10.

Put Global Asset Preservation Trusts to Work for You

- (442) 444-0078

Company

- Our Story

- Giveback

- How It Works

Get Started

- Free Consultation

- Order Form

Quick Links

- © 2025 Tyler Geffeney Mortgage. All rights reserved.

- |

- Sitemap

- © 2023 Tyler Geffeney Mortgage. All rights reserved. | Sitemap

Global Asset Preservation Trusts (GAPT) is not a law firm, CPA/Enrolled agent, nor financial or tax advisor and should not be considered to be acting in those capacities. This website is provided for information purposes only and should not be considered nor be construed as legal, accounting, financial, or tax advice. GAPT strongly suggests that Purchaser contact an attorney for legal advice, a CPA or equivalent for tax advice, and such other financial or tax advisors customarily consulted when in engaging in complex legal and financial transactions regarding the purchase, structure, and utilization of any product purchased from GAPT.